Dr. Arindam on Indian Economy

[A1]Raghuram Rajan is making things exciting, and it's not necessarily great news for India's crony capitalists!

31 January 2014 | Dr. Arindam on Indian Economy

Raghuram Rajan is potentially great news for the Indian economy. Anyone who talks about “Saving capitalism from the capitalists” has to be good news, for humanity per se. The IIT, IIM educated man is an intellectual of a relatively high calibre. Not that all his arguments are correct – mainly because of his lack of understanding of the positives of a planned economic system – but his heart is in the right place. Having spent most of his life in USA, his panacea for all ills, as expected, is capitalism. Where he scores however is his better understanding of capitalism’s ills and where capitalism’s ‘fault lines’ are. He has rightly championed the cause against monopolies and oligarchists – and that’s the key reason why he is the man India needs.

Rajan’s analysis about India very correctly observes that the big Indian billionaires (the guys I call “Blood billionaires”) are in those sectors where there is high government interference, and where licensing and price controls are highly prevalent. This is because this is where businessmen manipulate the government machinery and make their moneys. Thus, wealth gets concentrated in the hands of a very few and they keep becoming richer with the help of the government mechanism – the typical case of crony capitalism. Although ex-IMF people aren’t very easy to trust, the fact that from all his writings, one gets absolutely no feelings for crony capitalists, is what makes his presence far more exciting than the presence of most others before him. Perhaps before finishing his completely useless and disastrous tenure, Manmohan Singh without realizing has done India a great favour.

Before I explain further why Raghuram Rajan can do a lot of good, specially with his latest move, let me also comment a little on areas where he hasn’t been flawless. Amongst Raghuram Rajan’s bigger achievements is not just his ability to forecast the 2008 crisis, but also his competence of being sharper than others in understanding its causes and giving a better prescription to come out of it. Unlike another economist, Krugman – who happens to be one of my favourites and whose prescription is traditional Keynesian, a combination of fiscal stimulus of spending and investing more along with monetary stimulus – Raghuram argued that the flaw was on the supply side, that developed economies needed to free themselves from the bottlenecks of protectionism of firms and workers, and that they also needed to focus on retraining these very workers, making them more competitive and at the same time giving a bigger thrust to entrepreneurship at a smaller scale.

He is right to a large extent, and yet, here is where he goes wrong in his analysis of the American and European crisis and his suggestions become half baked. The problem is that it is not just an issue of supply side economics; there’s something deeper. It’s a fact that almost every earning citizen in the American and European economies has the next 15 years of income already spent through some or the other installment scheme on homes, cars, education et al. So stimulating the demand in these economies is an impossible task in itself; these countries need to realize this and come to terms with this factuality. Add to that the fact that the state of having material aplenty has reached that psychological threshold in these economies where making consumers buy more is becoming tougher by the day.

Thus, the real way for American and European companies to grow is to do to the African, Indian and Chinese labour force what Henry Ford once did to Americans. Pay them more so that they can buy American and European products and make these economies grow in turn – in simple words, develop these markets. So the real solution is to almost completely forget looking inwards for growth and instead look at developing the poorer nations instead. (Some would argue instead that Western economies should allow labour to freely flow into their nations so that Chinese and Indian educated cheap labour can replace American and European labour at half the cost; but then, this option obviously has various other complications and political repercussions, and therefore is an unlikely solution). This is inclusiveness at a global level, the real globalization of the world. This apparently can be called capitalism; yet, it is something that can be understood better by students of economic planning (at a global level) – I would call it global humanitarianism. The sooner developed nations, and their more human faces (the likes of Krugmans and Rajans) realize this, the faster these nations will spring back and so will the world. Else, it will continue to be like what’s happening now. An Apple or a Louis Vuitton brings out one landmark design to bring the American and European consumers out of their shells once a year; these are consumers who buy the product, and go back to their shells on the trot right after.

Although I think that Raghuram Rajan’s prescription for Western revival has flaws, I also believe India is a different ball game. It requires economics that is relatively devoid of larger philosophies and complications. We are where the West was decades back and our problems have more tried and tested solutions; and yet, at the helm, we require the key economics of having your heart at the right place. That’s precisely why Raghuram Rajan excites. His academic understanding of how free markets are beneficial, the important and visible role of governments in such free markets, at the same time his scathing attitude towards how the same governments are subject to being influenced by big private players, are what India needs at this point of time.

The need of the hour in India is to protect the free market from powerful and oligarchic private influencers, so that benefits of the market economy reach the masses and don’t remain limited to a few. Rajan believes in governments providing a social safety net, something that I am sure will certainly reflect in days to come in his decision making, through RBI policies that help the masses more than the richest few – be it through his measures to control inflation or his measures to control black money flow.

His latest act of doing away with pre-2005 notes proves the point, and to my mind, the move has great potential. Given the fact that he has no sentiments for crony capitalists, this actually is one of his initial big moves to entrap and finish off a large chunk of black money. Admittedly, till now, he has maintained that his move is not intended to flush out black money. Yet, the fact is that people with their huge stores of black money will no doubt find the going tough, as estimates say that pre-2005 notes in high values of 500 and 1000 make up about 20% of the total black money in circulation. Clearly, for those with black money inside the country, it will be a herculean task to identify and exchange this 20%.

As of now, the way the announcements have been made, it seems that it is still possible for one to freely go to banks and exchange the pre-2005 notes. But to me, this chance should be utilized to either make unaccounted cash impossible to exchange (the cash could be usurped and destroyed, if an exchange is attempted – at least 20% of black money thus could be made useless) or make people reveal their black money, by perhaps offering to make it white by levying a 20% tax on the disclosed amount. Without doubt, this is too big a chance to let go off, and especially now since the deed is already half done. Who knows, this act may even end up giving the current government the much needed boost just before elections! Irrespective of what he finally does, one thing is certain, like I said before: Raghuram Rajan is making things exciting, and it need not be great news for the crony capitalists of India!

[B1] DR. ARINDAM ON INDIAN ECONOMY

The BJP must talk of bringing back all the black money stashed abroad and stop corruption

31 January 2014 | Dr. Arindam on Indian Economy

I have written about these earlier too and I think the time is ripe to repeat the same. These are India’s biggest economic issues, yet, despite some voices here and there, nothing is being done about them on a red alert scale. Yes, I am talking about black money and corruption and how our politicians, hand in hand with bureaucrats and businessmen, have placed us at a shameful position with respect to these. If BJP really needs a unique differentiator to convince the electorate, then rather than just focusing on the economic development agenda, they should necessarily spearhead the fight against black money and corruption and not be just another voice speaking against these issues.

I collate out here various statistics that I’ve mentioned in some of previous editorials too, and you’ll see how pathetic India’s situation has become with respect to black money. As per various reports, the amount of black money stashed abroad by Indians is approximately $1450 billion, the largest in the world. If one wishes to compare, this is more than our entire national income. As per the same reports, while India is at number one in terms of the total black money stashed abroad, Russia comes in at the second place (at one third of the black money compared to the Indian figure), UK is at the third position, with Ukraine and China trailing it in the fourth and fifth position. As per media reports, in 1967-68, the black money in India was around Rs 3,034 crores (9% of GDP); this went up to Rs 46,867 crores by 1979 (49% of GDP). You can only imagine how the figures would have grown since then! The oft-quoted and much respected Global Financial Integrity (GFI) in its recent report said that India was the third largest exporter of black money in 2011, with $84.93 billion being exported in 2011. From 2002-2011, $343 billion of black money has gone out from India, as per their report.

Similar is the situation with respect to corruption and scams. While in the 1980s, India saw only eight scams of a significant nature, the 1990s had 26 such scams. The figure now has reached a whopping 150 plus! From animal fodder, coffins for soldiers, or real estate meant for martyrs, to telecom and even sports events like the CWG, wherever there has been a scam, there has been a collusion of the devious political class with bureaucrats and businessmen. In 2010, the late and most respected management guru C. K. Prahalad had said that corruption was costing India Rs. 25,000 crores every year, as per the FICCI-E&Y report ‘Bribery and corruption: Ground reality in India’, corruption cost India Rs. 36,500 crores in the period October 2011 to September 2012. A 2011 study by the research agency Indiaforensic is more shocking, as it puts the cost of corruption to India at Rs.1,555,000 crores in the last decade. Another study I read revealed that 50 million poor households have to annually pay around Rs 9000 crores as bribe to various authorities for getting their work done.

Back to black money, and Transparency International says that a huge 60% of black money generated is directed into the electoral process. And taking advantage of this debauchery by politicians (who get their major source of black money from businessmen), the business class has invested in various surreptitious tax havens throughout the globe! Mauritius, Cayman Islands, Bermuda, British Virgin Islands, select Scandinavian and European countries, and even countries like Thailand, Singapore, Hong Kong and Macau – destinations are innumerable for Indians to park illicit funds.

The example of Mauritius is quite interesting, and one that I quoted in one of my previous editorials. I had written then – and this holds now too – that how does one justify that Mauritius ranks first among all countries in Foreign Direct Investment (FDI) inflows to India while its national income is just around $9 billion, and its investment in the banking sector is just over $1.5 billion? 9,000 plus offshore corporate entities in Mauritius have their roots in India. Under the Indo-Mauritius treaty, and under certain other treaties, a Mauritius company can sell shares of an Indian firm and yet escape taxes as there is no policy of capital gains tax (CGT) in Mauritius.

Quite ironical that when ultra-rich countries like Switzerland, which clearly hoards an astounding amount of black money, are ready to cooperate with India, not many Indian politicians are ready to take that offer up. I think it’s quite understandable why they would not want to follow up! This is unlike the governments of other nations. For example, Germany paid $6.3 million to the LGT group in Liechtenstein and bought bank data to identify tax evasion. In 2009, US forced the Swiss government to give access to 4,450 secret accounts in UBS. Even Nigeria, after 18 years of trying, got back $700 million. So did Philippines ($700 million) and Mexico ($74 million)!

It’s time now for India. Rather, it’s time for the BJP to take the lead in the area of getting back black money and ending corruption. As I’ve said before, the black money lying abroad belongs to Indians; and that it must be brought back. And if corruption is killing India, then the BJP must necessarily punch it down transparently and show the electorate that they mean their words when it comes to improving India. Yes, the economic development agenda is a great one when other things are proper. But when we have two most critical issues that are destroying India with every passing day, then BJP needs to first pull India out of the muck, and then target the sky. If they wished to convince the electorate that they should be the party of choice to lead India, then ending black money and corruption should be at the top of their agenda.

[B2] DR. ARINDAM ON INDIAN ECONOMY

The United Colours of Globalisation!

31 January 2014 | Dr. Arindam on Indian Economy

Truly said, every coin has two sides. But when it comes to policies and politics, a random toss can be really catastrophic. The same can be said for globalisation. Of course, globalisation came with its own set of advantages and disadvantages. On the one hand where it made the world a melting pot, then on the other it also became the reason for the cracks on that very pot – making it fragile and susceptible.

With the advent of globalisation, the concept of nation-state – or rather, shall I say nationalism – gradually started diminishing! The world-order started getting governed more by knowledge and communication technologies. Along with knowledge and technology, the ease of mobility acted as catalyst to make the world smaller, more congested and heterogeneous. So when migration and cross-culture relationships were augmenting each other, in some other part of the world national identities were getting lost. That said, nationalism has the ability to enhance solidarity, but if not channelized under controlled conditions, then it can backfire as hostility and increase xenophobia. December 18 was International Migrants Day, a day when the United Nation’s officially exhorted people and governments to end xenophobia and to support migrant communities. But that’s easier said than done.

Recently, a nation famous for its stringent civilian rules and regulations and subsequently also for its benchmark target of zero crime, saw globalisation and xenophobia at loggerheads in the most unexpected manner, especially given the social history of that nation. A few days ago, hundreds of foreign residents in Singapore resorted to violence, vandalism and even attacked the police in one of the worst riots in the last four decades of Singaporean history, after a bus (evidently accidentally) killed an Indian migrant worker near Little India, a region that typifies India and is populated significantly by Indian migrants. The riots occurred despite the fact that Singapore has one of the most stringent laws for rioters. Without an iota of doubt, accidents are uncommon in Singapore where laws are followed religiously, literally and verbatim. But then, this one incident acted as a trigger to the suppressed animosity that foreign workers were carrying in their minds and hearts since long, due to their perception of being xenophobically (if one could call it that) targeted since long by the Singaporean nationals. This riot seemed more of a frustration emitting exercise by local Asians residing in Little India who are still not treated as par with permanent residents of the island nation.

[B3] DR. ARINDAM ON INDIAN ECONOMY

How patents are anti-poor and are harming essentials like healthcare worldwide

31 January 2014 | Dr. Arindam on Indian Economy

Come Diwali, the greatest Indian celebration, and a considerable number of people all over the country get burns and many die of burn-related injuries. One doesn’t realise the gravity of the situation till tragedy strikes at one’s doorstep. This Diwali, a small diya kept near a staircase, in twenty seconds straight, had my aunt (my brother-in-law and fellow TSI columnist Prashanto Bannerjee’s mother) in its deadly wrap. She, being a neighbour since my childhood, is perhaps closer to me than are any of my real aunts. Despite her saree being made of cotton, and despite my brother-in-law noticing the burning saree instantly and putting off the flames with buckets of water within twenty seconds, she got 65% burns – and at 72 years of age, that is dangerous... very dangerous! When we reached Apollo Hospitals in New Delhi – where we finally admitted her – the doctor told us that if she had been of Prashanto’s age, 36, he would have given her only a 20% chance of survival with the 3rd degree burns that she had. But then, there’s a small background story to all this. Prashanto’s mother was actually taken initially to Max Super Speciality Hospital. To our surprise, we were told by Max doctors to get her admitted somewhere else since they didn’t treat burn injuries… The quick research we did after our visit to Max gave us a shocking statistic. In Delhi, the capital of India, there are only two hospitals capable of treating burn injuries. Other hospitals in fact don’t even admit burn victims! And being Diwali, Safdarjung Hospital, the only hospital other than Apollo for burn victims, was expected to be very crowded. If Delhi has only two, then you can imagine how many hospitals does the average Indian city have that handle burn injuries – none!

Anyway, once she was admitted to the ICU at Apollo and we got talking to the doctor, and wondered how in such a big city such few beds were available for burn victims, his answer shocked us further. He said that a burn injury is a poor man’s injury and ergo didn’t have many hospitals as takers. Before this incident, it had never struck me that this was the case. It should have been quite obvious actually: it is the poor woman – and not really the man – who gets burnt when her saree catches fire from the kitchen stove kept on the floor. And when such poor women get burnt, it matters less whether they survive or not. Therefore, no hospital has been interested in investing in a burn injury center! What was sadder was that when I researched on the net and read about the tremendous advancement of medicines for burn injuries (that have reduced chances of mortality to negligible even in severe burn cases), I realized that we still lived in a country that, despite the spectacular international medical advancements, continues to have the highest number of people dying of completely curable burns.

Apollo, of course, is a very rich man’s place. And they were quite forthright about that – treating Prashanto’s mother would cost up to Rs.90,000 per night, with medicines alone costing up to Rs.60,000 per night. And these are the per day costs of treating a ‘poor man’s injury’! No wonder, a treatment center for a poor man has barely any takers. In fact, even if your nearby hospital were to start a burn injury center, chances are that even the rich man wouldn’t be able to bear the expenses for a two-month treatment, forget the middle income or poor man. And that’s what makes me write this piece on patents today.

I have always been very excited about movements like copyleft (the anti-copyright movement) and have believed that one of the best things that the internet has done is to open the doors to zillions of gigabytes of knowledge-ware to mankind free of cost – from software to top end research studies. And I so hope that patent laws across the world too are drastically changed soon for the betterment of mankind. In fact, in his book called Sex, Science and Profits, Professor Terrence Kealey argues how there is absolutely no need to give patent rights to anyone for 30 years, when in reality the costs of research studies with high profits can be recovered back in three years on an average. By exploiting such a mindless number of years of patent rights, companies fool us on the costs of research and rob the poor worldwide of their dues. Not just that, unduly long-term patents keep essential medicines extremely expensive and away from the reach of the poor – and patents also additionally slow down innovation. Every technology and formula kept patented for 30 years consequently means there would be much slower progress on further extensions to that technology or formula due to the patent-gifted monopoly. History is evidence that the moment the patent right over a technology has concluded, the progression on that technology has become extremely fast compared to the past years of hardly any innovation – like in the case of the steam engine.

It’s time that we come up with a humane formula for deciding the number of years that companies can be granted patent rights – or we cut the patent protection period drastically short to suit the interests of the world and especially its poor, instead of keeping patents mindlessly favourable towards the rich corporations and their profits. And while the time period of patent rights for every other sphere can still be debated over, in the arena of medical sciences, this must be changed with immediate effect. Additionally, policies similar to the Indian National Pharmaceutical Pricing Policy 2012 – which puts a cap on the prices of 652 popular medicines – must be notified with an immediate effect and should necessarily be expanded to include not just life-saving high cost patented medical drugs, but also high cost medical treatments and operations.

In the meanwhile, as Prashanto’s mother fights a brave battle on her 30th day in hospital – thanks to one of the few beds on Diwali night we could pay for, while many other not so fortunate souls couldn’t – friends, when anyone you know of goes through an unfortunate fire accident and gets burnt, remember this: just rushing her to the nearest hospital might be of no use – for it’s considered a poor man’s injury for which your nearest hospital, even if it’s a Max, may have no treatment facility.

[B4] DR. ARINDAM ON INDIAN ECONOMY

How WTO is anti developing nations!

31 January 2014 | Dr. Arindam on Indian Economy

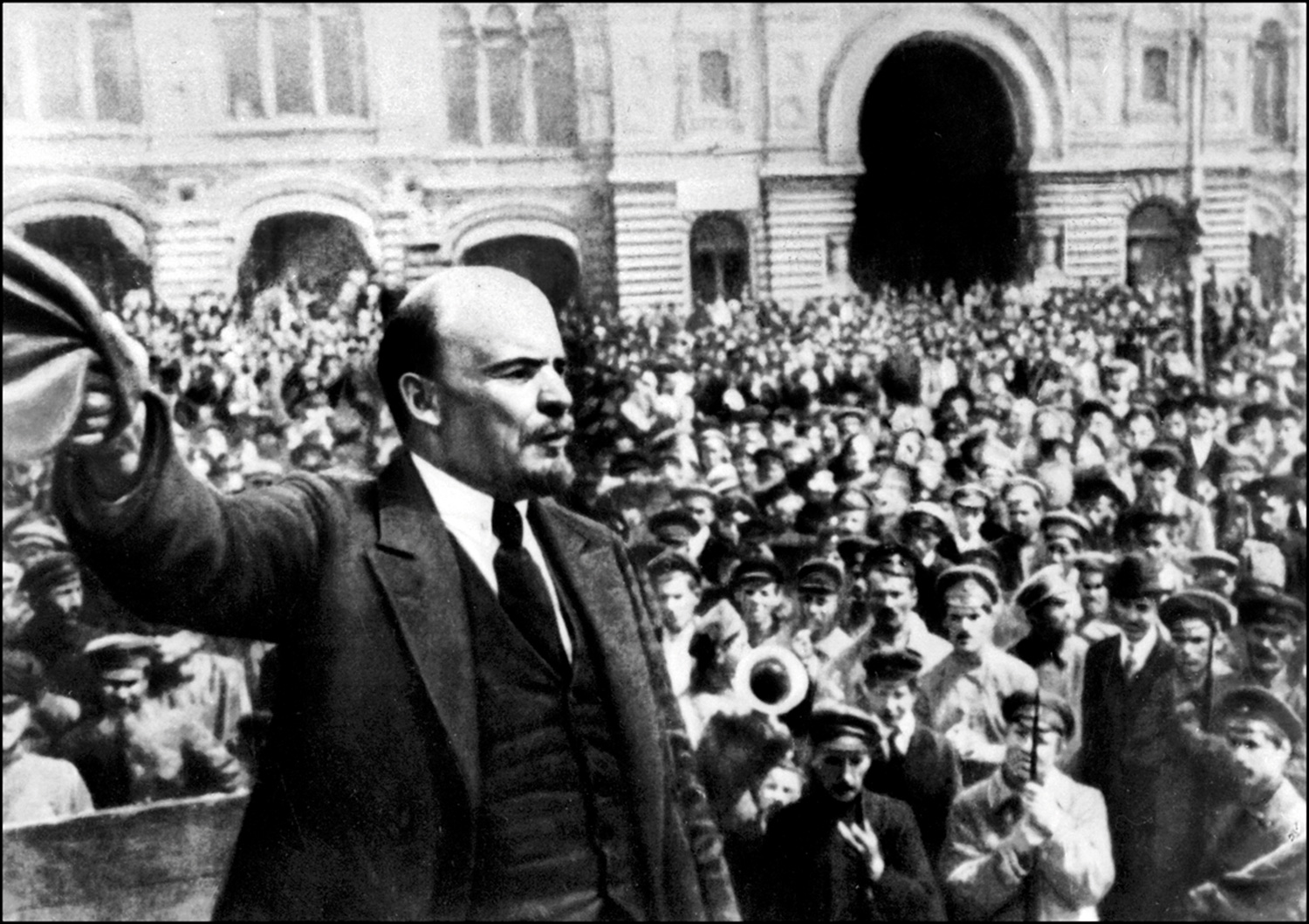

The era of colonialism is over. However, exploitative trade practices by First World countries against poor nations are still alive and kicking. Overly biased import policies by richer nations, who weave a complex web of tariffs and duties, set the tone of discrimination against Third World countries.

For instance, Bangladesh-made garments entering the US market are slapped with duties and taxes/tariffs that are in general 20 times higher than those that UK-made garments have to face. Similarly, imported Indian garments have to face import tariffs of around 19%, as compared to the 0-1% charge applicable on European and Japanese garment imports. Such discrimination debilitates the value additions made by producers belonging to poor countries. According to internal estimations of Brazil, its agricultural exports’ earning has reduced by more than $10 billion because of trade barriers in the West. For Mozambique, exports to EU are lower by $100 million a year because of restrictions that are almost equal to the total amount of financial aid it receives.

‘Free trade’, as advocated by WTO, is nothing but a myth. Richer nations, led by United States, spend a billion dollars a day in extending subsidies to their farmers. The figure is six times the amount of aid they provide to the poorer nations. These domestic subsidies extended by rich nations to their farmers work in two ways against poor nations. First, these subsidies act as export barriers for poor countries – as their generally low priced produce becomes relatively costlier in the export market. And second, the surplus produced in the rich nations, because of the protection and supportive subsidies, is dumped easily at lower prices in developing countries, thus putting the local producers in these poor nations out of business.

The discriminatory and potentially catastrophic policies pursued by developed nations are usually endorsed and even backed by WTO. The deals struck through the framework of WTO more or less protect the interests of the rich countries while turning a blind eye to poorer nations – one reason why the November 2013 WTO General Council Meeting turned out to be another big failure, with members failing again to agree on a trade deal.

WTO has also failed miserably in its promise of fairness and justice. Despite its commitment to improve access to its expensive legal system and make it easier for poor nations to file suits, nothing much has been done. In the last one and a half decades, no African nation could file a suit or was a complainant; merely one ‘less developed nation’ filed a claim. In a paper titled ‘Is WTO Dispute Settlement System Biased against Developing Countries? An Empirical Analysis’ by Fabien Besson and Racem Mehdi of University of Paris, the authors write, “Within the context of trade disputes increase, the position of developing countries draws special attention. There is evidence that developing countries have a disadvantageous position in the WTO DS system. Park and Panizzon (2002) provide statistical documentation of the WTO disputes initiated between 1995 and 2001. Roughly one third of WTO disputes (80 out of 235) have involved developing countries as plaintiffs, which is slightly higher than their share of disputes initiated under the GATT period. On the other hand, developing country defendants have been the target of roughly 45 per cent (109 out of 242 disputes) of WTO disputes, which is much higher than was the case under the GATT. Most developing and all the least developed countries have not used the system even once since its inception, whereas the G4 countries (EC, USA, Japan and Canada) are over-represented.”

In addressing Blue Box subsidies (unfair trade subsidies in rich countries), which directly contradicts the vision of WTO, no timetable has been finalized by the organization to decide its fate. The stubbornness of EU and US in holding onto their stands is made easy by passive (and sometimes even active) support of WTO and other global economic bodies. The EU’s refusal to offer anything beyond its Common Agriculture Policy, which is an already agreed reform, demonstrates the attitude of the Western nations towards the developing ones and highlights the helplessness of WTO in resolving unfair trade practices pursued by the West. Despite the WTO’s stand for free trade, EU, Switzerland, Norway and Japan have been able to protect their so called ‘sensitive products’, with no voices raised against them by the organization.

To be fair, not many global forums or organisations have been able to uphold their founding motives and core objectives; still, WTO is one that leads the list of such organisations. Instead of bridging the gap between two worlds, it is exactly doing the reverse. WTO, through its policies, is only facilitating the process of rich nations growing richer at the cost of the growth of poor countries. Fundamentally, its allowing the West to gain economic and political control over the developing and underdeveloped world. The era of colonialism begins, again!

[B5] DR. ARINDAM ON INDIAN ECONOMY

Making Macau out of Andaman and Lakshadweep!

31 January 2014 | Dr. Arindam on Indian Economy

While I was contemplating what to write in this week's editorial, James Packer was publicly announcing his plans to invest $400 million for a casino resort in Sri Lanka. In a speech at the Commonwealth Business Forum in Colombo, he said that his casinos would act as ‘‘a leading tourist mecca for the rising middle class of India, China and the rest of Asia.’’ Without a doubt, Packer has got his figures worked out pretty well. Despite a domestic ban on gambling, Indians do illegally indulge in various forms of gambling and betting every year. Some reports suggest that the size of the domestic gambling and betting 'industry' could be beyond $60 billion a year; and this is not counting the amount Indians spend abroad in casinos and betting centres. However, most of these instances are not in public view and are virtually impossible to track. Here is where the government needs to make smart plans to exploit the benefits of both the worlds. Going by the way India wishes to increase tourism, and perhaps even minimise the number of Indian tourists going abroad (to save foreign exchange), the authorities need to seriously consider setting up domestic gambling centres as these could give quite a significant impetus to tourism revenues, given the lessons that are there to be learnt from Vegas, Macau and Singapore. Can ‘Incredible India’ and mini-Vegas, for the sake of argument, exist at one place? I am not advocating that India adopts gambling blindly – given the negative connotation the word exudes – nor am negating the social malaises that gambling might bring, but am simply pointing out that the government should at least review the undeniable global correlation that exists between GDP growth and setting up legalised gambling and betting centres within the country.

If the worry is that legalising gambling in India could increase social exploitation, one could explore setting up of such centres in stand-alone territories like Andaman and Lakshadweep islands, test out the initial waters and economic benefits, and depending upon the experiences and lessons learnt, open up more centres in other states. Opening highly regulated casinos in such stand alone territories may actually give a huge boost to employment and lifestyle in these regions.

Las Vegas is a case in point. Thanks to gambling, Las Vegas today has an impressive employment rate and low tax burden. Similarly, legalising gambling turned the odds in favour of Mississippi. In another case, Tunica – one of the poorest counties in the Mississippi delta – today boasts of a low unemployment rate, low food subsidies and low state welfare expenditure. Even during the slowdown, in the year 2010, the American Gaming Association confirmed that gaming services contributed almost $125 billion to America’s GDP, apart from providing 820,000 jobs and raking in close to $49.7 billion from tourists. As per the Casino Association of South Africa, casinos have contributed 143 billion rand to South Africa’s GDP since being legalised in 1996.

Macau, one of the most-sought after gambling hubs in the world, has seen itself growing at light-speed! The province not only has seen a surge in employment and lifestyle but has seen a huge increase in per capita income, which today stands at around $78,000 – 10 times the average Chinese income and notches above the average American income. And this didn’t take centuries to happen. It literally happened overnight. Macau is well-connected to China via water, air and land and witnesses around 80 million Chinese visiting this province, spending over $100 billion every year. Today, by various estimates, the revenues earned by Macau is six times that of Vegas. The Statistics and Census Service confirmed recently that the region’s quarterly economic growth was propelled by an 8.5% increase in exports of services, specifically gaming.

However, amidst all nations, one nation that has exploited the benefit of capitalism, yet kept socialism intact is Singapore. It is a classic case of ‘Happy Capitalism’. The nation today has some of the world’s largest casinos and generates revenues close to what Vegas generates, but has been successful in keeping the social malaise out of the system. On the one hand, the island nation invited two of the world’s biggest casino companies to open gaming resorts in the nation, and on the other, it formulated laws that kept the doors of the casinos closed for its own people. The nation has strict rules for Permanent Residents (PRs) with respect to gaming halls and casinos. Locals are usually discouraged from entering these halls and are heavily prosecuted in the case of a breach of law. The Singapore government, does however allow locals to stay inside a casino for 24 hours straight on the payment of S$100 (Singaporean dollars) or have multiple entries per year on the payment of S$2000. At the same time, the government of Singapore also regularly educates casino operators about discouraging locals and has released mandates for creating ‘virtual walls’ between locals and casinos. Notwithstanding that, civil servants and bureaucrats in Singapore are prohibited from entering casinos and gaming centres. Bureaucrats having an annual pass for entry into casinos need to regularly submit detailed logs describing their visits to casinos.

A statutory board called the Casino Regulatory Authority of Singapore (CRA) is responsible for administration and enforcement of the laws as laid down by the government. They ensure that no one (including tourists) below the age of 21 years is allowed entry into the casinos; the operators under no circumstances extend credit limit for the PRs; no automated teller machines (ATMs) are installed within the casino premises; problem gamblers are stopped from entering the gaming halls. Moreover, with the setting up of the National Council on Problem Gambling (NCPG), families can get their family members banned from entering casinos. Even families of adult foreign students studying in Singapore can apply for such bans on their wards. As of last count, around 90,000 people have been banned on individual requests while another 1500 have been banned on family request. And of course, any citizen who has filed for bankruptcy is by default banned. Additionally, no direct casino advertisements are allowed in any form. Taking it steps ahead, the government has banned opening of any independent casinos; only resort-casinos are given licenses to operate.

Looking at the Singapore example, why can’t the Indian government invite international casino giants to open integrated casino resorts in Andaman and Lakshadweep and convert them into the Macaus of India? Like I mentioned above, it would not only increase tourism but would also encourage tourists visiting south-Asia to alter their itinerary and add India to their travel plans. However, like Singapore, there should be strict rules in order to keep locals and Indian nationals away from gambling, or there should at least exist structured caps on betting amounts, depending upon income and family approval of Indians. But under no circumstances should such resorts be replicated in the hinterland and under no circumstances should locals be allowed to enter casinos regularly. With Kazakhstan, The Philippines, North Korea and Taiwan, planning to do a Macau themselves, it would be a bad bet to for India to not explore this potential opportunity!

[B6] DR. ARINDAM ON INDIAN ECONOMY

Agriculture needs more holistic reforms

31 January 2014 | Dr. Arindam on Indian Economy

“While, like last year, I seek the blessings of Lord Indra to bestow on us timely and bountiful monsoons, I would pray to Goddess Lakshmi as well. I think it is a good strategy to diversify one's risks,” are the words of the ex-finance minister (and now President) Mr. Pranab Mukherjee during his budget speech for the year 2011-12. The statement is symbolic of the unfortunate ways in which our ministers have been keener on invoking Gods and Goddesses rather than depending on science and technology and straightforward ground level solutions to come to the rescue of India's dwindling agriculture sector, which employs around 50% of India’s workforce, but is decreasing in its contribution to the GDP year after year. “As per latest estimates released by Central Statistics Office (CSO) the share of agricultural products/Agriculture and Allied Sectors in Gross Domestic Product (GDP) of the country was 51.9 per cent in 1950-51, which has now come down to 13.7 per cent in 2012-13 at 2004-05 prices...” This statement of Minister of State for Agriculture Tariq Anwar last month in a reply to a query in the Rajya Sabha shows the pathetic downfall of a once glowing sector. Even in absolute terms, India’s foodgrain production declined to 250.14 million tonnes in 2012-13 from 259.32 tonnes in 2011-2012.

What continues rising in this sector is just the number of farmer suicides, which reached a shameful figure of 15,440 in 2012, close to 50 farmer suicides every single day of the year, as per the National Crime Records Bureau. The government itself admits that since 1995, more than 300,000 farmers have committed suicide.

Leaving aside our pseudo-intellectual ministers, it’s more important to understand the real problems of agriculture. At the farm level, the usual suspects are clearly the ones that are addressed the least. The acreage in India has been around 140 million hectares, but with the number of farmers increasing, the divisions in land have resulted in decrease in productivity and diminishing economies of scale, what to say about reduced financing options and killing debt traps. Apart from this, lack of irrigation, warehousing/cold-storage facilities, and an almost non-existent technology support from the government also are critical issues for farmers, pushing them towards destitution.

But what takes the cake in the whole value chain is something else. Every year, like an annual event or an Indian festival, vegetables and agri-products find themselves in a comedy circus. On the one hand, our government boasts of record yields, whereas on the other, this so called hollow boast of ‘record yields’ fails to reach its real customers. Think about it – as per the government, we’ve had one of the best monsoons this year. The Central Water Commission confirmed in August 2013 that our water reserves nationally are now at an ever-high level in a decade. We’re apparently experiencing a bumper crop year. Clearly, such a claim is laughable when you consider the rising prices of fruits and vegetables all around.

SubmitBut then, isn’t that the case every year? Every year, onions, tomatoes and other essential food items find themselves being upgraded from basic necessities to luxurious items. And the chief culprits for this and the related obscene price rise are hoarding and black marketing. However, despite repeated offences by traders and recurring problems of agri-products pricing, not much heed towards agriculture reforms at the ground level has been given. Unlike other nations, agriculture in India is still treated as a child of a lesser God. Take for instance China. After 1994, the government of China introduced policies that limited the amount of grains that could be imported (giving a boost to domestic production). This brought the domestic farmers to the centre stage and increased the domestic supply of crops. In 1995, a policy named “Governor’s Grain Bag Responsibility System” was incepted, which made the local governors accountable for supply and demand and also for maintaining the prices in their jurisdiction. Later, by the end of 1997, China introduced agricultural industrialisation management strategies for professionalising the flow of produce to the market and morphing the entire agriculture system into a market-oriented system. The next in the line was balancing production in urban and rural areas, wherein urban industries were asked to facilitate agriculture and guide rural farmers for better yields. The reforms didn’t end here.

Comprehending the need for sustainable development and long-term progress, the agriculture reforms included compulsory rural education, financial security, internationalisation of farming and market openness. As I wrote in one of my previous editorials where I compared India and China, as per a World Bank study, an Indian farmer contributed $400 to the agriculture sector back in 1994, which increased to $500 by the end of 2009 (a mere increase of 25 per cent); while a Chinese farmer increased his contribution by 85 per cent and is currently adding $550 to the sector. Going further, the Chinese government has definite and clear-cut policies to check food inflation, price rise and hoarding. All big traders are provided with guidelines to report to the authorities within 24 hours if they decide to increase the food prices by 4 or more per cent. Moreover, criminalising unethical activities, the government has provisions of imposing penalties on those cartels (especially for traders dealing with flour, rice, noodles, cooking oil, milk and gas) that are found influencing prices. The fine can go upto a million yuan and imprisonment. Besides all these reforms, China also adopted land reforms to allow every farmer to own his land for agriculture and exposed their farmers to scientific and technology-oriented farming. This is evident from close to 10,000 agricultural patents that today China owns compared to around 50 by India. In a similar tone, Argentina allows its authorities to freeze prices and imposes fines and imprisonment in case of any breach.

Contrast this with India. The conviction rate under the Essential Commodities Act, 1955 and the Prevention of Blackmarketing and Maintenance of Supplies Act, 1980, was only 2.47 per cent in 2009, 3.55 per cent in 2010 and 6.68 per cent in 2011. While unlettered Indian politicians exclaim that the rise in prices will benefit the Indian farmer – without realising that the Indian farmer is still selling at the minimum price only, while the so called ‘benefit’ is being gained by the hoarder and final retailer – others can’t even make up their mind on whether export bans should be put in place to rein in prices. In 2011, an onion export ban (that was put in place because of rising onion prices) was lifted in ten days flat by a committee of Empowered Group of Ministers, led by – no surprises – the then finance minister Pranab Mukherjee. The situation is quite similar even now. On August 13, 2013, Food Minister K. V. Thomas said, “We would wait for 10 days and if the prices do not comedown, would ban exports,” Minister said. On August 23, 2013, just ten days later, he said, “Currently there is no proposal under consideration to ban the export of onion... Prices of commodities including vegetables like onion and tomatoes are mainly governed by market forces of demand and supply, cost of transportation and storage, weather conditions etc.” But then, where’s the ground level action against hoarders that should have been undertaken days, if not weeks ago?

Increase in onions prices is just an indicator of several malaises that are floating seamlessly in our agriculture system. For a start, the agriculture ministry should immediately take steps to introduce stringent laws against hoarding, publicly arrest hoarders and initiate action against them, and open the market further for agriculture produce. After all, here we are talking about policies that are not for a few crore farmers but for the entire nation and for the larger good of the economy and society.

[B7] DR. ARINDAM ON INDIAN ECONOMY

Private Equity: The double-edged sword!

31 January 2014 | Dr. Arindam on Indian Economy

When it comes to Private Equity (PE), there can be numerous schools of thought. You have the group that would completely go gaga over PE. You have another that would simply want to wipe off this infatuation from the market. There is also one that would hold PE responsible for failed, inefficient and weak government policies. In India unfortunately, what we have (mostly) seen so far is the havoc that PE has caused. And I clearly see it as one key reason that has snowballed into the economic crisis that we face today.

It was back in 1946 when PE emerged in the American market in its true sense. The era between 1960s to 1980s saw the Vanderbilts, Whitneys, Rockefellers and Warburgs build fortunes in businesses ranging from real estate construction projects to airlines, banking to whatever moved on the streets of Silicon Valley. Running parallel and equally fast was Warren Buffet, who through Leverage Buy-Outs (LBOs) acquired one corporation after another. The US Congress then opposed every change in tax policy that could have made life more difficult for PE firms (the Carter Tax Plan of 1977 was the first of such acts that failed to be enacted). What followed up until 1990 was quite understandable (given the quick, sweet success PE had witnessed in its early years). Thousands of PE labels mushroomed across the globe.

But beneath this rolling of the Red Carpet was a weakly-constructed foundation. Cracks on the PE wall first became visible in the first half of the 1990s. Ills related to the massive rise in leveraged buyouts that were financed by junk bonds led to the-then collapse of the LBO industry. Amidst various companies that went into a tailspin was a big name – Drexel Burnham Lambert. This one company that was credited for the boom in PE back in the 1980s had several allegations made against it. The firm was charged with insider trading and had to file for Chapter 11 in 1990. Thus, one of the founding pillars of PE was turned to dust. Companies and markets across the globe experienced a similar avalanche.

The ‘true’ global effect of PE became more publicised and shamefully dramatic in the early 21st century. It began with the dot-com bubble bursting. This disaster has so far caused the maximum damage because it sent more than just tremors across the global financial market. It shook the very belief in Private Equity (and Venture Capitalism). In the quick years that followed this early 2000s disaster, more than half of PE firms that had invested their dimes and coffers in web start-ups were forced to throw in their towels. Of course, the market as a whole, and the investors were left at the mercy of no modern capitalistic gods. Many IT firms that had become bigger with the prime support of PE saw the cash and asset balance levels in their wells fall. Much below even the amount of capital initially invested! And the biggest reason for such an unwanted outcome was that those very PE firms that had promised to fuel their dreams ran out of fuel themselves. They backed out in the name of retreat and failed to live up to their investment commitments. By the end of the year 2000, globally, the count of PE firms fell by a horrific 50 per cent!

Obviously, India was not one to remain idle when it came to being mesmerised by this hypnotic trick and believing in the permanent magic of a volatile formula. It was one of those markets that felt the maximum impact of the dot-com bubble slap. The Indian IT industry came under huge pressures – returns vapourised for some time and much hope was lost. There are huge apprehensions still – that have spread to other verticals. Even today, every now and then, cases of insider trading and embezzlement are reported across various sectors. And we’re not even counting unrevealed scams yet. Private equity dealings in the first decade of the 21st century has left us in ruins. Worse, during this period, PE entered one sector after another and that resulted in excess supply being created. The bubble of a hope that PE generated ruined organisations far and wide – some temporarily and some forever – with excess pressure of expansion that has left them in a complete mess with visible supply-demand mismatch.

Take for instance the case of the much-hyped – and one that still finds fanatic believers – industry (in India) called Real Estate. Real estate was once considered an immovably strong and non-volatile sector. Then came PE intervention, and left the industry in a shambles. It’s one heck of a mess you cannot just ignore. Back in the 1997-2003 period, withdrawal of funds by PE led to a crash in Mumbai region’s real estate business. The same was repeated in the 2011-2012 period when prices of real estate properties fell by 20 per cent (and higher) in Delhi and Mumbai. The fundamentals of the entire sector have seen a paradigm shift after the SEZ Act of 2005. Most residential and commercial concrete jungles that were built post-2005 were aimed towards investors who wished to park their money in real estate properties. Ghost towns were being built all around the metros and bigger cities, and were sold at prices that were headed for the moon. [Forever it seemed.] What is the present scenario? When PE investors decided to stop funding such ‘(not-so-)concrete’ dreams by cutting off the supply of money, the expected came to pass. Empty malls, vacant residential properties, half-completed high rises and incompletely dug up construction sites with building material left untouched for months is a common sight. Not many souls move about in such ghost towns these days! How PE has totally tricked buyers and sellers in an entire industry is an incredible story to be told. But not one to gain inspiration from.

Holistically stated, the purely economical repercussions of PE’s entry and exit across sectors and markets have also led to several socio-economic crises. In a 2011 study by the University of Chicago, Harvard Business School and the US Census Bureau, it was proved that “companies tend to terminate more employees after a buyout compared to competitors in the same sector.” “After a PE buyout, employment in existing operations tends to decline relative to other companies in the same industry by about 3 per cent. Many of those job losses are undoubtedly painful,” writes Prof. Steven Kaplan, the Neubauer Family Distinguished Service Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business, in a 2012 article titled, ‘How to think about Private Equity’. But PE investments always offer higher returns given the risks. Right? Actually, no! In a 2005 study by Prof. Steven Kaplan of the University of Chicago Booth School of Business and Prof. Antoinette Schoar of MIT, covering the period ranging from 1980 to 2001, it was revealed that, “Investors actually made slightly less on PE deals than they could have by investing in an S&P 500 Index fund.”

All in all, PE funding not only degrades and makes a sector volatile but also injects malpractices into companies. Thought leaders have not been very vocal about it, but in the West, film-makers have tried to depict the same through their works. Today, PE funding worldwide is headed southwards. And that is good news. It implies greater stability for the global economy as a whole. A more sustainable future, if I may add. In the last one decade or so, PE ownership across companies has reduced by leaps.

Going back where I started, when it comes to PE funding, there are several schools of thought, but when it comes to India, the thought that PE can and will leave you in ruins appears most logical. The Indian government has to be very careful going forward about the manner in which it allows PE to enter any given sector – whether it be for the sake of developing Greenfield projects in the most undesirable of sectors or for the sake of lighting a bulb in the most underdeveloped of villages.

PE is a double-edged sword. Popular perception is that it makes you stronger – but only until you measure the blood you have lost. Period!

[B8] DR. ARINDAM ON INDIAN ECONOMY

Gold reserves of India can make India a golden bird again... at least economically!

31 January 2014 | Dr. Arindam on Indian Economy

Many may not be aware, especially in our part of the world, that back in the year 1933, on April 5, US President Franklin D Roosevelt signed one of the most controversial orders in American economic history. The Executive Order No. 6102 criminalized the possession of gold by individuals and corporations and forbid “the hoarding of gold coins, gold bullion, and gold certificates within the continental United States.” This order was an extension of the Presidential Proclamation No. 2039 that criminalized the hoarding, possession and ownership of gold or bullion, and imposed a monetary penalty of $10,000 (equal to more $170,000 in today’s value) and imprisonment for as long as ten years on individuals falling foul of the law.

Obviously, such laws on hindsight look very undemocratic and politically suicidal; but then, if one were to explore it and go beneath the surface, the big picture may gradually get vivider. In tough economic times, gold and similar forms of monetary elements can become a key source of increasing money flow in the market. One should remember that most nations (including ours) have at one time or the other even printed money based on the amount of gold kept in the federal bank (Reserve Bank of India, in the case of India). In other words, hoarding of gold by communities, corporations and individuals not only decreases the flow of money (given the unproductive capital locked within such hoarded gold) but also to a large extent disturbs the supply-demand equilibrium of gold and bullion. Before I reach India, let me in brief discuss the way Uncle Sam tapped (or as many critics would say, exploited) the Executive Order No 6102. The order forced every American citizen to surrender all their gold, leave 160 gms, to the Federal Reserve in exchange of a fixed amount of money. After receiving most of the gold, the US government increased gold prices manifold, thus churning out a huge amount of profit, which was used for the Exchange Stabilization Fund (ESF), a fund that enables the American government to control currency exchange rates. In 1964, the previous laws were modified and the ownership of ‘gold certificates’ was legalized, followed by the legalising of gold trade in 1974 – after almost three and a half decades.

The importance of and aspiration for gold ownership in India requires no introduction. Despite economic turmoil, the consumer demand for gold is up by 51 per cent in Q2 2013 while the demand for gold bars and coins is up by 116 per cent. As per various unofficial estimates, more than 60,000 tonnes of gold are lying idle in the form of jewellery and ornaments all across the nation. Going by the current price of gold at the rate of Rs.35,000 for ten grams, this unaccounted reserves could create a possibility of reaping about Rs.2,10,00,000 crores in money supply! Going by World Gold Council figures, Indians hold 20,000 tonnes of gold (which is an absurdly less figure, as a single temple in South India holds more than 1000 tonnes of gold); even considering this reduced figure of 20,000 tonnes (which is 33% of the unofficial estimates), the amount we’re talking about would be nothing less than Rs.70,00,000 crores!

Against these jaw-dropping numbers, what looks hilariously minuscule is the state of RBI. Despite such huge national deposits of gold, RBI has an official reserve of a mere 550 tonnes of gold, compared to 1000 tonnes of China (which is again debatable) and 9000 tonnes of US.

The Government of India should immediately draft and announce a Central Gold Bond scheme, where it should ask people to deposit their gold with the government in lieu of Central Gold bonds at a fixed rate of interest of around 9%. One reason I mention this percentage is because in my calculations, I have realised that despite the huge surge in gold price, in the last 65 years the same has increased by only around 9% per annum compounded. With respect to the government’s gold bond scheme, people should of course be allowed to take back their gold after say a period of 15 years. The same will be applicable for temples, trusts and other similar institutions; for them, the government could even make it compulsory to deposit all gold and make hoarding beyond a limit illegal. These institutions should be thankful that the government is not nationalizing their gold hoardings, given the immense employment generation potential this money can have. Thus, a huge percentage of gold in physical form would be directed to the Reserve Bank, which, in turn, would utilise the same to increase the money flow and to adjust the exchange rates of our currency. Similar schemes have been in the past practiced by many European and African nations, with the latest being Venezuela.

This one scheme would serve several purposes. Firstly, it will make the INR stronger, subsequently boosting international trade, especially our mandatory imports; because, with the INR getting weaker, the cost of doing cross-border trade is increasing and the old deals signed at old exchange rates are becoming infeasible to continue. Secondly, it will create huge employment opportunities if the money so sourced is invested honestly in infrastructure or for energy generation/oil production and other such extremely key needs of this country. The money thus minted should only be used for employment generation and entrepreneurship, which eventually would increase jobs in the market and would spirally improve the flow of money further. Thirdly, the entire process of converting physical gold to paper gold would decrease the incidents of gold smuggling and gold hoarding and above all make all gold possession transparent.

Apparently, as of now, it is impossible to even estimate the amount of gold lying inside our nation; and most of these gold hoardings have evaded taxes too; as even today, domestic consumption of gold is not through authorised outlets but through trusted local gold traders. In such cases, tax-evasion is a cake-walk.

Such schemes would obviously invite criticism, but when the economy is going through tough times, the political corridors need to take some tough and non-populist steps. The only apprehension that I see here are scams and corruption. Even an iota of embezzlement would create a dynamo effect and ruin the entire economy and social harmony. In such a situation, the entire execution needs to necessarily be politically independent and under a body such as CAG or Supreme Court with everything being tracked electronically and centrally. The fall of INR to Rs.68.80 per dollar is a matter of utter shame, especially after luxuriously introducing an expensive sign for rupee! After all, as they say, looks can be quite deceptive!

[B9] DR. ARINDAM ON INDIAN ECONOMY

There is nothing called a Free Trade Agreement!

31 January 2014 | Dr. Arindam on Indian Economy

In a recent comment, the Gujarat Chief Minister Narendra Modi expressed grave concerns on the outcome of a little known Free Trade Agreement (FTA) that the Indian government is hastily attempting to sign with the the European Union. His concern was that the impact of this proposed EU FTA on the domestic dairy and animal husbandry industry in India would be debilitating if cheap European dairy products supported heavily by EU subsidies get inroads to Indian consumers. His fears are not unfounded. Indeed, if top European multinational dairy brands like Lactalis, Friesland Campina or Arla Foods with turnovers of $12.7 billion, $11.2 billion and $8.7 billion respectively get access to the Indian market on the backs of zero or minimal import duties, India’s biggest dairy brand Amul (Gujarat Cooperative Milk Marketing Federation) providing livelihood to more than 1.5 crore dairy farmers in rural India might not survive for long. True, Nestle, one of the world’s biggest food products companies, has definitive footholds in India – but Nestle India has entered India through the FDI route than the FTA route, it purchases products significantly produced within India, provides massive employment in and around production plants built in India, even though its holding company is the Nestle S.A. Of course, Nestle too would be advantaged by the proposed EU-India FTA, but it’s a different ballgame when EU-government subsidised products are imported directly from Europe with little entry barriers. Digest this figure. In February this year, the EU 2014-20 budget was announced. Of the 960 billion euros budget, a mammoth 38%, or 363 billion euros, was allocated purely for farm subsidies, which will without doubt make EU farm and dairy products ridiculously cheap compared to Indian products which any way suffer from massive cost additions due to various infrastructure issues. If these are the things to come, then the so-called ‘Free’ Trade Agreement could well turn out to be our costliest trade agreement.

The EU-India FTA discussions caught steam back in 2008. However, because of the sensitivity of the issue, the progress had been shrouded in utmost secrecy with little or no data available. Of late, the discussions progressed more, so much so that the Prime Minister, Dr. Manmohan Singh, even came out with a surprisingly strong statement in July 2013, “We have entered into Comprehensive Economic Partnership Agreements with the ASEAN countries as well as the Republic of Korea. We are hoping to conclude a similar agreement with the European Union soon”. Most political parties are silent on the issue despite the fact that the implication of such an agreement is enormous. An FTA generally means the lifting of trade barriers and an unhindered flow of goods and services with minimum import duties, intellectual property rights, government procurement, and competition policies between the nations bound by the agreement. So, if the EU-India FTA gets signed, then one could well imagine world class corporations like IKEA and Carrefour competing with domestic brands at prices that are cheaper than those of domestic products! Can our indigenous brands compete with these behemoths? Since any FTA encourages direct imports, it is not a natural builder of employment, rather a reducer of the same, as over time, domestic industries shut down giving way to cheaper imports. Thus, it is ridiculous to tom tom the point that FTAs eliminate poverty and help the destitute with a better living; they clearly don’t do that.

Various reports mention how FTAs in Senegal in 1990s led to employment cuts by 30-35 per cent, especially in the manufacturing sector. Similar trends were observed in Sierra Leone, Uganda, Sudan, Ghana and other African nations. Due to the influx of foreign goods, the domestic industries and markets in these regions either collapsed or never had the minimal support to even start.

In the year 2000, EU and Mexico signed a so-called ‘Global Trade Agreement’, which was trumpeted as the beacon of development and economic success. As per the agreement, Mexico had to deregulate 95 per cent of their goods and services industries in order to allow foreign goods into their markets. However, within three years post-GTA, Mexico’s GDP growth was crawling at 1 per cent, with their trade deficit touching a figure of 80 per cent. The rural-urban employment gap got wider, thus creating lot of social and local tension in the region. Eventually, the quality of basic goods deteriorated and created an oligarchic market where the access to water and electricity became tough and inaccessible to the poor. Mexico destroyed employment, domestic trade and became a nation that is today being tormented both economically and socially. Still, Mexico currently has FTAs with around 44 countries. Significantly due to this, they were one of the hardest hit during the economic slowdown, wherein their GDP plummeted by more than 6% during 2008-09. As per economic surveys, the poverty level on absolute terms has gone up from 35 to 46% during the period 2006-2010. Of course, the rich in Mexico have become richer during the same time.

Indian FTAs are leading to similar results only. A joint study by Corporate Europe Observatory and FDI Watch slammed the proposed EU-India FTA. The authors of the study mention, “The EU and the Indian government have handed the negotiation agenda over to corporate lobby groups, ignoring the needs of their citizens. It is an outrage that two of the world’s biggest so-called democracies should behave in this way.” And the issue is not just limited to dairy and agricultural products. A paper titled ‘India-EU free trade agreement – should India open up banking sector?’ concludes the following, “The proposed India-EU trade agreement is likely to further constrict the access to banking services in the country, geographically, socially and functionally... The provisions in FTAs are likely to further destabilise the financial system and so make future crises more likely.”

Médecins Sans Frontières (MSF) wrote an open letter to the Indian Prime Minister last year drawing attention to “specific harmful provisions in the proposed intellectual property (IP) and investment chapters [of the EU-India FTA], that if included would have serious implications for access to affordable medicines in India and throughout the developing world.” Similar have been the arguments of global aid agencies like Oxfam, Stop AIDS Campaign, Health Action International (HAI) Europe and Act-Up Paris who protested against the EU-India FTA outside the European Parliament in April 2013.

An April 2013 paper by Indian automobile industry body SIAM on the EU-India FTA mentions, “Opening the [automobile industry] to imports/lowering import duties under the EU FTA is a retrograde step and will have a severely damaging and long term irreversible effect in several ways for the Indian economy, auto industry and consumer at large.” Similar are the statements of other industry bodies like CII, FIEO etc which are strongly cautioning the government against signing FTAs. India signed an FTA with Japan in 2011. Imports from Japan grew by over 3 per cent to $12.5 billion in 2012-13, while our exports to Japan fell down to $6.26 billion from $6.32 billion one year ago. India signed a free trade agreement with ASEAN nations in 2009. Look at the economics since then. India’s trade deficit with the ASEAN group has increased to $18 billion in 2012-13 from $14.9 billion in 2009-10. Is it any wonder that in the year 2012-13, India’s current account deficit reached a historic high of 4.3% of GDP? We cannot afford to continue with these FTAs which are not only destroying employment and domestic industries, but also are devastating our foreign exchange reserves, one reason the rupee has now plummeted to record lows (and was Rs.61.86 per dollar on August 7, 2013, a never before seen low).

When it comes to poverty reduction, the world doesn’t really require such hollow and lopsided policies like FTAs, rather what we require are fairer wealth distribution policies. Today, the wealth accumulated by the hundred richest persons in the world is enough to end global poverty four times over! Shockingly, the wealth of the top 1 per cent has increased by 60 per cent over the last two decades and was not even affected by the last financial crisis. And there is every likelihood that any FTA-driven Indian economic growth, if at all, would be a jobless one, and might not be sustained in the long run. We don’t need FTAs with other nations to increase their wealth; we need poverty reduction policies for our people; and the government should realise this at the soonest.

[B10] DR. ARINDAM ON INDIAN ECONOMY

SEBI's claims on Sahara start crumbling in Supreme Court, as TSI predicted

31 January 2014 | Dr. Arindam on Indian Economy

In April this year, I had written on how various points in a 2012 Supreme Court judgement against the Sahara Group on the basis of an earlier SEBI order were clearly erroneous and went against even Constitutional Acts. (Read the article here http://www.thesundayindian.com/en/story/the-unputdownable/25/47189/). I had titled the article ‘The Unputdownable!’ as an appreciative sobriquet for Subrata Roy Sahara, the Sahara Group Managing Worker, who, despite various attempts by external entities to pull him down – the English media in India included – has come back with exemplary credentials.

First the background to this case and on the face-off that Subrata Roy Sahara has had with SEBI, and in this I liberally refer to my previous article. The Sahara group, which has issued OFCDs (Optionally Fully Convertible Debentures) since the year 2001 with all relevant government permissions, and which has regularly submitted all details as required by the concerned government authorities, suddenly got a prohibitory order from SEBI in November 2010 against the OFCDs issued by two unlisted group companies (Sahara Housing Investment Corporation Ltd. and Sahara India Real Estate Corporation Ltd.) – and this despite the fact that just seven months before that, SEBI had, through its own communication to Ministry of Corporate Affairs, commented that as these were unlisted companies and had not filed a draft red herring prospectus with SEBI, any complaint with respect to these two companies should be handled by the Ministry of Corporate Affairs.

Of importance is the fact that the Ministry of Corporate Affairs, in its written submission to the Allahabad High Court in 2010, mentioned, “The issuance of OFCD [by] the petitioner company after the registration with the Registrar of Companies has been permissible under law. The Central Government remains the regulating authority for the company.” Similar were the notings of the Additional Solicitor General, Mohan Parasaran (who is now Solicitor General), and of the Minister of Corporate Affairs, Veerappa Moily.

True to its past, SEBI disregarded all this and brought out an order against the two Sahara companies in June 2011, demanding that they immediately pay back all the moneys collected through OFCDs, with due interest.?After subsequent hearings in the Securities Appellate Tribunal, finally in August 2012 in the Supreme Court, the two Sahara firms unfortunately again received the short end of the judgement, where the judges asked Sahara to pay back the OFCD moneys with interest. The fact is that a few of the statements within the August 2012 Supreme Court judgement seemed to be wrong.

For example, referring to the hard copy of investors’s details that Sahara had handed over to the court, one of the Supreme Court judges said that one of the introducer/agents mentioned in the hard copy, a man named Haridwar, apparently couldn’t have had that name. The judge wrote in the order, “Haridwar, as a name of a person of Indian origin, is quite uncomprehendable [sic]. In India, names of cities do not ever constitute the basis of individual names. One will never find Allahabad, Agra, Bangalore, Chennai or Tirupati as individual names.” It took me all of five minutes to put paid to the Supreme Court judge’s contentions. For example, typing Haridwar on Google got me to Dr. Haridwar, much awarded erstwhile Director of DRDO, Ministry of Defence.

Also, the judges weren’t clear on how much money was in contention. While one of the Supreme Court judges giving the order on Sahara believed that the OFCD money collected by two Sahara firms was around Rs.27,000 crore (“Saharas have no right to collect Rs.27,000 crore from three million investors,” Justice K. S. Radhakrishnan), the other judge believed that the amount collected was around Rs.40,000 crore (“What the two companies chose to collect through their OFCDs was a contribution to the tune of Rs.40,000 crore,” Justice Jagdish Singh Khehar).

Not only that, the Supreme Court’s August 2012 judgement wrongly gave powers to SEBI much beyond the SEBI Act, and directed SEBI to attach “all and any bank accounts” related to the two companies in case the two Sahara firms fail to comply with the orders. But as per the SEBI Act, SEBI can attach only those bank accounts “or any transaction entered therein, so far as it relates to the proceeds actually involved in violation of any of the provisions of this Act, or the rules or the regulations made there under...”; also, the bank accounts could have been attached for only a month as per the Act.

The Supreme Court order resulted in SEBI moving ahead and attaching not just the movable and immovable properties of the two companies involved, but also of other group companies (and this point about other group companies anyway wasn’t mentioned even in the Supreme Court judgement). SEBI’s mindless drive to attach accounts and properties of other group companies of Sahara and of shareholders goes not just beyond the SEBI Act, but beyond the very basis of capitalism and the distinction between group entities and between shareholders, that the Indian Companies Act clearly defines.

The Sunday Indian was the first and till now perhaps the only media house that came out vociferously against this stupendously faulty move of SEBI. As a basic tenet of capitalist business, no sensible investor would ever invest in an Indian company in case SEBI and the Indian courts start transgressing the clear line that demarcates a company’s incorporation – giving it a definitely independent legal status as compared to its group companies and its shareholders.

In my earlier article, I wrote how our respected finance minister spoke that we cannot have rich promoters and sick companies, and that banks therefore should start acting against promoters in such cases. Amusingly, if banks extended this rule to the government’s loss making companies like Air India, the Rashtrapati Bhawan could well be attached any time soon.

But that’s what SEBI decided to do against the Sahara group post the August 2012 Supreme Court order. They made a plea to Supreme Court on July 30, 2013, strongly requesting the Supreme Court to act against Subrata Roy Sahara for not following the earlier Supreme Court order, and that too simply because he is, as per SEBI, a shareholder holding a 70 percent stake in the companies. This is despite the fact that Subrata Roy Sahara is not a Director in those companies, and he cannot be held legally liable. In other words, what SEBI wishes the Supreme Court to enforce is that from now on, any significant shareholder of any company can be indicted for the company’s shortcomings. In other words, if you hold a significant number of shares in Unilever, and if there’s any court order against Unilever, you might as well get ready for SEBI’s Chairman Mr. U. K. Sinha pulling you up to pay on behalf of Unilever. I consider this behaviour of SEBI similar to kangaroo court proceedings.

SEBI also pleaded to the court that the Sahara Group was a single economic entity and any group company’s commitments were liable to be paid by the other group companies. Clearly, this line of argument is exactly what is wrong with SEBI’s understanding of modern day capitalism. And in a brilliant turnaround, the Supreme Court judges refused to accept SEBI’s contention. “...The other [Sahara Group] companies have not given any [such] undertakings,” Justice Radhakrishnan commented, while Justice Khehar flatly questioned the SEBI counsel, “Each of these [Sahara Group companies] are individual companies; to what extent can we proceed against their assets?” The SEBI counsel, having no plausible reply as of then, said he’ll argue the point later.

One should also note that SEBI pleaded in the Supreme Court that Sahara Group’s newspaper advertisements berating SEBI and bringing out SEBI’s clear misrepresentations, amounted to contempt of court. To this, the bench, after studying the advertisement in contention, amusingly replied to the SEBI counsel, “This is not contempt [of the court]. The expression used in the advertisement is for you.”

In conclusion, all I can say is that while the August 2012 case against Sahara seemed to be completely against the laws of natural justice, Parliamentary Acts and Supreme Court mandates, the recent reconsideration by the Supreme Court of a few critical issues that have the potential to destabilize the tenets on which capitalism is based – in other words, the protection provided to shareholders, and the fact that group companies cannot be held responsible for other group companies financial issues – is an extremely positive step and one badly needed to rein in the so-called market regulator which has suddenly become obsessed with lynch-mobbing Subrata Roy Sahara and his group of companies.

As I had written in my previous article, while Subrata Roy represents the other India, what I call Bharat, the English media just can’t handle the trust this other India holds in him and his Sahara group of companies. It is time we start changing such a mindset and ensure that capitalism and capitalists are not punished purely because one market regulator decided that they could make the rules and break them whenever they wished. And this change has to be initiated by the Supreme Court at the earliest.

[B11] DR. ARINDAM ON INDIAN ECONOMY

The need for credit expansion in India

31 January 2014 | Dr. Arindam on Indian Economy

India had been one of the fastest growing economies till early 2011. For almost half a decade before that, along with China, India was clocking over 8 per cent GDP growth annually and talks among analysts were ripe that India, along with its neighbour, would spearhead Asia’s rise in the new world order of the 21st century. However, things have gone awfully wrong for us ever since! The growth rate has kept plummeting, ebbing now at less than 5 per cent in the previous financial year; even till date, there is little light at the end of the tunnel. Two of the foremost reasons for such bottoming out are dried up investments and a rising current account deficit, which are becoming worse with each passing year as the burden of the global slowdown becomes heavier. While our current account deficit has reached a record 4.8% of GDP in FY 2012-13, as per a recent chamber of commerce report, new investment proposals from domestic and foreign entrepreneurs have dried up by 75% as compared to the previous year. As compared to 2,828 investment proposals in the fiscal year 2011-12 worth Rs.6 lakh crore, the figure in FY 2012-13 was 697 proposals worth Rs.1.4 lakh crore.